Get An Unbiased, Qualified and Professional Financial Advice : A Comprehensive Financial Navigator is Here

Who am I

Why you should work with an Independent Licensed Financial Planner?

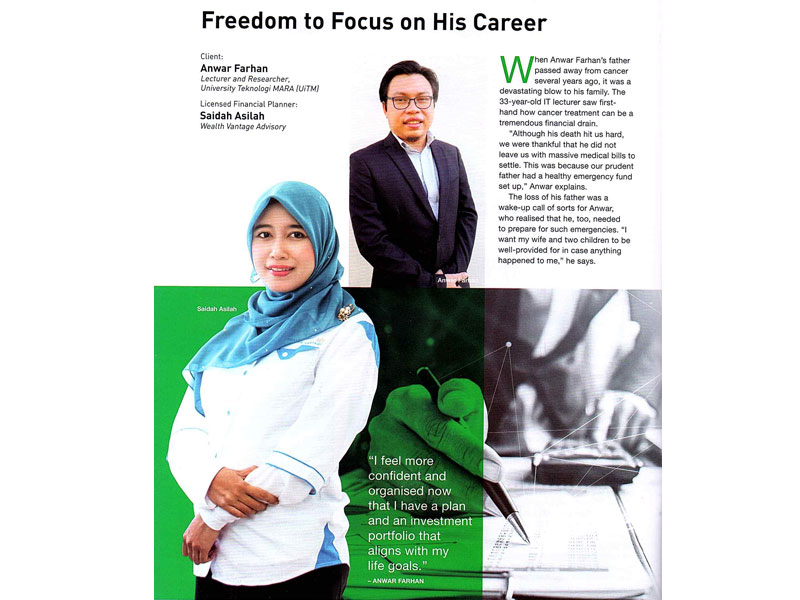

With a decade of experience in the financial industry, I am now a Licensed Financial Planner that holds a Capital Markets Services Representative’s License from Securities Commission Malaysia. I am both Certified Financial Planner, CFP and Islamic Financial Planner, IFP® that works proactively based on your interest. As your Independent Financial Planner, there are multiple providers to help you on your journey to financial freedom. Being independent, I understand the part played by the multiple providers (such as unit trust companies, stockbroking firms, insurance companies, banks and lawyers) or even your wished plan. It is my job to coordinate all your asset lists and report to you whether worth to keep or not.

Benefits of engaging Licensed Financial Planner

You avoid buying any insurance policy that gives unnecessary protection.

You will not commit to risky investments based on factors such as emotion, support friend or relative or self study/own judgement. You will grow in knowledge to become aware of the potential risks you are exposed to.

You will not delay and miss out on investment opportunities regardless market conditions.

You focus on job that you are skilled, get better and leverage time to research to your financial advisor.

You do not have to carry out all the research into potential investments on your own.

You will get someone to monitor your performance and organise all your financial information.

Benefits of engaging Licensed Financial Planner

You avoid buying any insurance policy that gives unnecessary protection.

You will not commit to risky investments based on factors such as emotion, support friend or relative or self study/own judgement. You will grow in knowledge to become aware of the potential risks you are exposed to.

You will not delay and miss out on investment opportunities regardless market conditions.

You focus on job that you are skilled, get better and leverage time to research to your financial advisor.

You do not have to carry out all the research into potential investments on your own.

You will get someone to monitor your performance and organise all your financial information.

Area of Expertise

Comprehensive Plan

covers all aspects of planning your personal finances and life goals

Succession Planning

planning for business continuation

Health Care Planning

medical, surgical, dental, critical illness, disability, etc for individual / family

Financial Security

ensuring stable stream of income for individual / family

Credit Protection

debt and contingency planning

Child Tertiary Education Planning

securing your children’s education

Retirement Planning

pre and post retirement planning, management of retirement fund

Estate Planning

timely wealth distribution

My types of services

Individual Financial Health Check

Modular Financial Planning

Comprehensive Full Financial Planning

Corporate Financial Awareness Workshop